We’re only in it for the money. That key trading

concept is obvious but shouldn’t be forgotten. The reason why this

mantra is key is because we’re not into trading for the following

reasons:

-To Beat the Market

-To Show People How Smart You Are

-To Feel Excitement through use of Aggressive Leverage

If you’re interested in learning what else, besides emotions, it takes to trade like a professional trader, register for our free course here.

Why Emotions Get Shunned By Traders

Some traders opt for an Automated Trading or Black Box strategy.

The purpose of a black-box system is to have your preferred trading

rules or edge programmed so as to put you into a trade and exit you from

a trade when the edge is gone or the profit target is achieved. The

argument of this approach is that your emotions can’t get in the way of

you entering or exiting a trade. However, a trading career is made up of more than just on trade

and if you do not have the emotional strength to stick with your edge,

programmer or discretionary, then your emotions are still getting the

best of you.

Either way, your emotions are at play. If you’re

deciding when to enter the trade yourself, known as discretionary

trading, your emotions are obviously at play. The way emotions effect

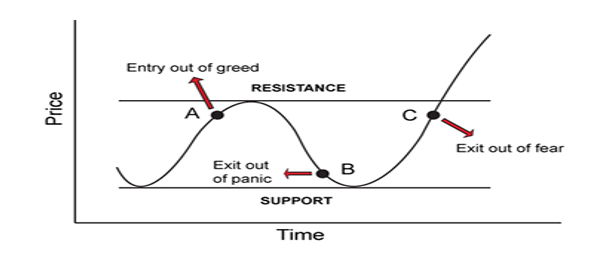

newer traders is that new traders hope their losses will come back so they let them run in order to avoid booking a loss. They fear that their profits will turn into losses so they cut them short. However, this fear and hope tug-of-war doesn’t work out in the traders favor in the long term.

A Better Way to Look at Emotions

Emotions aren’t bad if you know how to steer them towards your benefit. By

default, you likely don’t like being wrong or losing money, who would?

However, taking a big picture view, being wrong sometimes and losing a

little money when deciding if the market is going to move in the

direction you believe it will, these two things aren’t that bad and are

in fact, inevitable.

So a better way to look at emotions is to flip how

you’re using hope and fear and most specifically fear. If you can switch

your fear from a place of fearing a losing to trade to fearing a losing

trade getting out of control, you’ll discover a key emotional truth to

trading well, regardless of your balance.

As the opening quote mentions, instead of hoping

that your loss will turn into a profit so you don’t look like a failure,

you should hope that your profits grow larger while always fearing a

large relative loss. By flipping these from there default function,

you’re no longer holding onto a losing trading waiting for it to come

back while closing out your good trades at a minimal profit afraid that

the profit will slip through your fingers. As Michael Martin put it,

that’s like pulling your flowers and letting your weeds flourish in

hoping they change.

Applying Your Emotions to FX Trading Appropriately

So now that you know that your emotions are not your

enemy when appropriately adjusted, what’s the best way to apply this

information? This may come as a shock, but you need to start from the

premise that you don’t know FOR SURE if your next trade will hit its

protective stop or profit target. Of course, you’d prefer that every

trade hit its profit target but by now, you know that’s not always the

case.

However, like the picture from above, you’re not

sure if the next trade will take you off the road you were planning on

driving down (read: the trend bends or ends to get you out of your

trade). Therefore, when you’re in a trade based on your edge or

indicators, it’s best to keep an eye for trades that go against you from

the start and see that it’s best to fear these trades and get out there

or just accept that your profit target most likely will not get hit but

whatever you do, don’t remove your stop and hope for a trade that goes

sour right away. These are the trades you should rightly fear draining

your equity.

On the flip side, if you’re entering at the right

time and price (unbeknownst to you or not), and the trade goes in your

favor right away, then it’s best to keep the hope in play that this

could be a big move that makes your day, week, month, or year and move

your stop up to break even when your system sees it appropriate.

I’ll leave you with a quote from Michael Martin

that’s been helpful for me and I hope it does the same for you. “Winners

never quit, but quitters have more equity in their accounts when they

admit defeat and return tomorrow with a fresh start and a clear head.”

This world of trading is a paradox, the trading paradox involves embracing losing trades early and often while allowing those few golden trades make your year.

Now that you're familiar with a new way of handling emotions while trading, feel free to try this information out on a FREE Forex Demo Account with access to multiple markets.

No comments:

Post a Comment