While the question of money management may seem fairly straightforward, it remains the most critical component of any trading plan.

Before placing a trade, traders should examine exactly what the risks

associated with that trade. This includes asking some tough questions

about stop placements, risk totals, as well as risk reward levels. To

help answer some of these concerns today we will tackle some tips for

better risk management. Let’s get started!

Plan Your Exit

More often than not, traders have an idea of where

to exit the market when a trade is moving in their favor. While a profit

target is always good to have, every trader should have a contingency

for when a trade moves against them. Stop losses can be set in a variety

of manners, but more often than not these levels are coupled with an

existing value of support and resistance.

Remember, a stop order is a point on the graph

where your trade idea is considered no longer valid. If you have buy

orders in place, and a key level of support is broken with price making a

lower low it may be time to consider exiting the trade. As well, the

opposite is true in a downtrend. If a trader is selling while prices are

making higher highs it may be time to look for a new trading idea!

The 1% Rule

After you have planned a point of exit, traders need

to decide how much to risk per trade. Since it is inevitable that at

one point a trade will close at a loss, it is important to know exactly

how much you intend to lose prior to that occurring. One way to

determine this is the 1% rule. Simply put, this means traders should

risk no more than 1% of their TOTAL balance on any one trade idea. For

instance if you have a $10,000 balance at no point would you want to

risk more than $100 on any 1 trading idea.

The 1% rule can also be coupled with a favorable

risk reward ratio. Using a 1:2 setting, this means if we risk 1% in the

event of a loss, at minimum we should look to close our trades out for a

2% profit. This would translate into a $200 profit on a $10,000 account

balance. Now that you are familiar with the 1% rule, let’s look at our

next risk management tip.

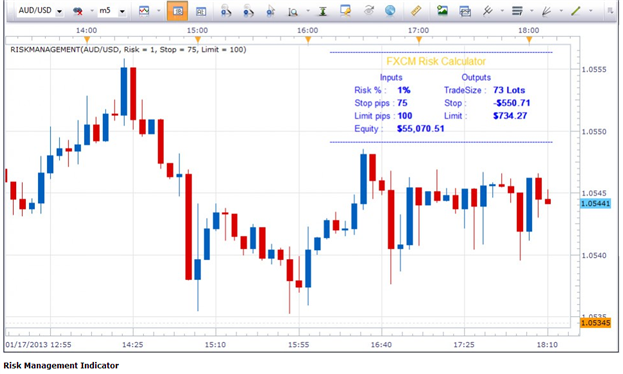

FXCM Money Management App

To help traders control and manage their risk,

programmers at FXCM have created a simple indicator to help decipher how

much risk is being assumed on any one particular trade. Once added to

Marketscope 2.0, the FXCM Risk Calculator, as depicted above, has the

ability to help a trader calculate risk based off of trade size and stop

levels.

We walk through the application, as well as how to

manage risk in several videos embedded into the brainshark medium. After

clicking on the link below, you’ll be asked to input information into

the ‘Guestbook,’ after which you’ll be met with a series of risk

management videos along with download instructions for the application.

No comments:

Post a Comment