From late 2012 to the 1st trading day of 2014, many traders felt the downtrend in the JPY

which pushes higher JPY crosses couldn’t be stopped. A lot of the

downfall in the JPY has been on the back of a major monetary policy

committee. For a while, the monetary policy taken on by the Bank of

Japan seemed to have all but sealed the victory of their war

on inflation all the while weakening the JPY. However, 2014 hasn’t been

kind to those looking for a weaker JPY and given the impending

EURJPY - An Impressive Trend

When you step back, you realize the EURJPY was the

perfect long trend trade based on each country’s monetary policy

standings in mid-2012. In late July, Mario Draghi of the European

Central Bank stated that they would do, “whatever it takes”, which

marked the low in many EURO crosses. At the same time, Shinzo Abe was

running for Prime Minister in Japan, and he was promising a restoration

of economic pride by raising inflation which would weaken the JPY and it

did. This made EURJPY a screamer to the upside since summer 2012, but

2014 has brought of shifting of tides that could allow us to find a

trading opportunity to the downside.

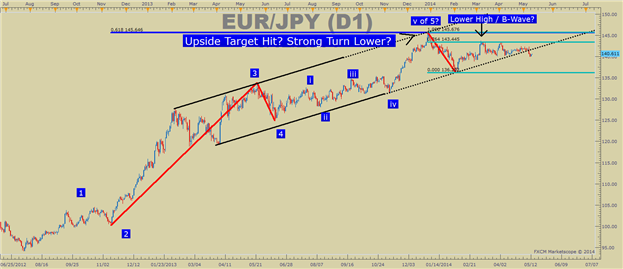

Learn Forex: EURJPY Has Finally Found Resistance

Presented by FXCM’s Marketscope Charts

The bottom left of the chart has the low put in

before Draghi’s comment mentioned earlier. As Euro strength began to

gather steam, so did JPY weakness. The JPY weakness ran throughout the

currency world but was most cleanly seen in EURJPY, which rose 5,100+

pips from mid-2012 to the beginning of 2014. After this strong push

higher, we’re going to look for a reversal or trend trading correction

as per Ichimoku rules to help us enter a higher probability trade.

Long Term Resistance

If we’re looking for a trade against the trend from

mid-2012, the first thing we want to see is levels and tools like

oscillators that show us that EURJPY is running out of steam. We have

both in looking at the Relative Strength Index & the 2009 intraday

high of 139.214 which are tipping us off to the potential for a strong

turn to the downside. Additionally, Elliott Wave also shows common

patterns that play out before another counter leg-move. If you’re

unfamiliar with Elliott Wave, here’s a quick breakdown of the tenets.

Learn Forex: 2009 High Could Soon Break As Support

Presented by FXCM’s Marketscope Charts

Looking above, you’ll notice that the 2009 Top is

under pressure and a handful of Fibonacci Resistance levels clustered

around the 144 level which as acted as resistance for a majority of

2014. The RSI tool shows us a clear divergence from the May peak to the December ’13 peak so that we can look for moves lower. Lastly, before we get to Ichimoku for triggers, you can see from the top chart that

a trendline dating back to February 2013 and the October ’13 low broke

last week, which further shows us weakening of the uptrend. Now, let’s

look at Ichimoku.

Ichimoku Set-Up with Key Levels

Last week, the European Central Bank said that they

were comfortable with the idea of cutting rates in June in order to ease

the pressure of low inflation on the economy. This week, ECB member,

Vitor Constancio said that he estimated the high levels on the EUR

have likely been the reason for 0.5% drop in inflation in recent

months. As the ECB began to express distaste for a higher Euro, many

traders began to sell aggressively and that brings about an opportunity

on EURJPY.

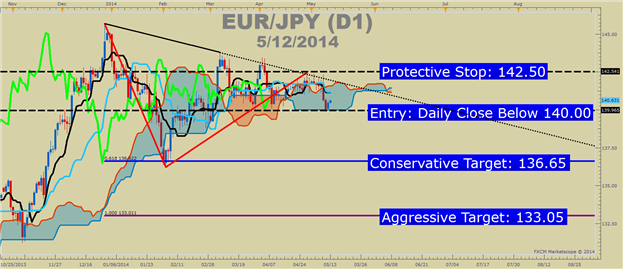

Learn Forex: A Lagging Line Bearish Break Would Trigger a EURJPY Short

Presented by FXCM’s Marketscope Charts

Ichimoku Trade: Sell EURJPY on a Close & Lagging Line below Daily Cloud @ 140.00

Stop: 142.50 (Above Exhaustion Point of Triangle and 2014 Trendline)

1st Limit: 136.65 (Just above 2014 Low & 61.8% Expansion of A Wave from End of Triangle)

2nd Limit: 133.05 (Equal Wave Target whereas C=A)

If this is your first reading of the Ichimoku report, here is a recap of the traditional rules for a sell trade:

-Price is below the Kumo Cloud

-The trigger line (black) is below the base line (light blue) or is crossing below

-Lagging line is below price action from 26 periods ago (we also received confirmation on cloud bounce)

-Kumo ahead of price is bearish and falling

-Entry price is not more

than 300 pips away from base line as it will likely whip back to the

line if we enter on an extended move.

No comments:

Post a Comment