Talking Points:

- Volatility breeds breakout trading opportunities.

- 24-period Donchian Channel on an Hourly chart can give us medium term trade entries.

- Stops can be set opposite of the channel break using 1:2 risk and reward ratio.

While trend trading makes up the bread and butter of

my personal trading account, I also employ a breakout strategy that has

yielded positive results. It’s true that breakout strategies require

more time and energy than longer term trend strategies, but breakouts

are easy to trade when you have set rules to follow.

The ideal breakout trade is on a currency pair that

has exhibited a high level of volatility and then breaks a key support

or resistance level. Pairing this type of opportunity with a sound money

management plan can result in a trading edge. Today, we are going to

lay out this simple, no-hassle breakout strategy in 3 steps.

Step 1: Look for Volatility

Not all market conditions are ripe for breakout

trading. We need to first find the pairs that have shown the most

volatility. While you can independently figure out what pairs are the

most volatile by ‘eye balling’ it, we prefer using DailyFX’s Technical Analysis page.

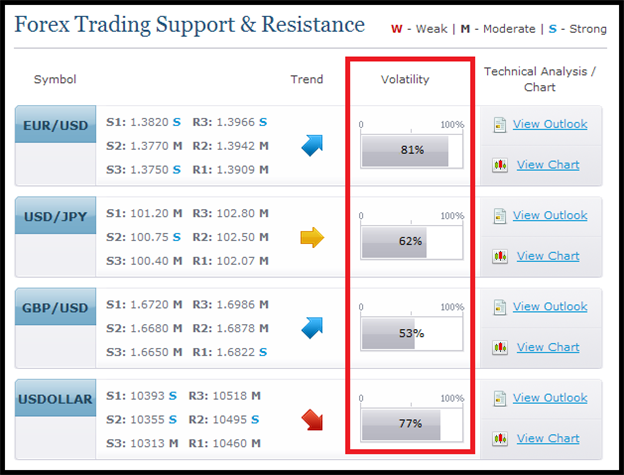

Learn Forex: DailyFX Technical Analysis - Volatility

(Copied from DailyFX.com’s Technical Analysis page)

The image above shows volatility highlighted in red.

A 0% reading means a pair has shown almost no volatility while a

reading of

100% means the pair has shown an extreme level of volatility. For the purposes of breakout trading, we recommend a reading of 75% or greater. So we need to make note of each pair with volatility above 75% before we move on to our charts.

100% means the pair has shown an extreme level of volatility. For the purposes of breakout trading, we recommend a reading of 75% or greater. So we need to make note of each pair with volatility above 75% before we move on to our charts.

Step 2: Find Trade Entries Using Donchian (Price) Channels

Support and resistance levels are subjective and can

vary from trader to trader. So to more clearly define our entry levels,

we use Donchian Channels or Price Channels. If you have never

downloaded and installed the Donchian Channel indicator from FXCM Apps,

you can download it for FREE by clicking here.

Once installed, you will find the Donchian Channel

on your indicator list. The following are what settings we will use for

spotting entries on an Hourly (H1) chart.

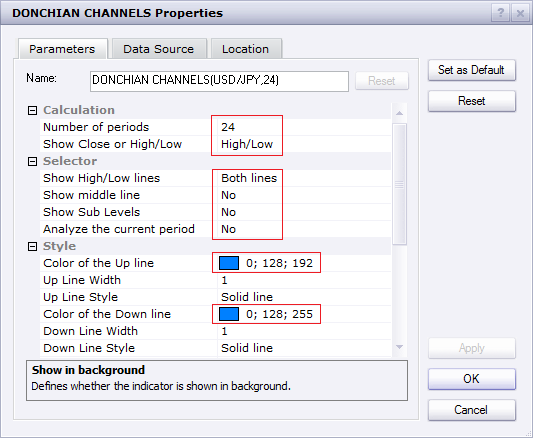

Learn Forex: Donchian Channel Settings

(Created using Marketscope 2.0 Charting Platform)

Once applied, we will see two blue lines on our

chart, one above the price and one below. These lines will act as our

trigger for placing a trade. If an hourly candle closes above the top

blue line, we initiate a buy trade at market. If an hourly candle closes

below the bottom line, we initiate a sell trade at market. Nice and

simple.

Step 3: Easy Exits Using Stops and Limits

No strategy is complete without an exit strategy.

Fortunately, the Donchian Channel can assist in setting one up. We first

want to focus on our stop. I recommend setting our stop loss beyond the

other side of the channel. So if the price broke below the bottom line

and created a sell trade, we would set our stop a few pips above the top

line. If price broke above the top line and created a buy trade, we

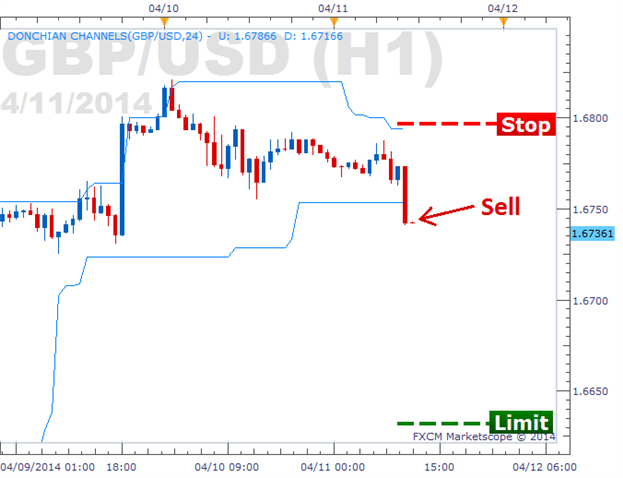

would set our stop a few pips below the bottom line. The image below

shows an example of a recent sell signal on the GBPUSD with a stop loss set above the top line.

Learn Forex: GBPUSD Breakout Trade

(Created using Marketscope 2.0 Charting Platform)

After we have set our stop above the upper channel

line, we want to set our limit twice as far as our stop. So if our stop

was 55 pips away from our entry, we would set our limit 110 pips away.

The goal is to give us a 1:2 risk reward ratio which is an important piece of a winning strategy.

Give Me a Break

Trading breakouts doesn’t have to be hard. Once we

know what rules to follow, everything falls into place. We want to find a

volatile currency pair, witness a break of the 24-hour Donchian

channel, and set a stop loss beyond the channel with a limit set twice

as far. Feel free to email me with any questions you have.

Good trading!

No comments:

Post a Comment